franchise tax bd co

On remand the Nevada Supreme. Follow the links to popular topics online services.

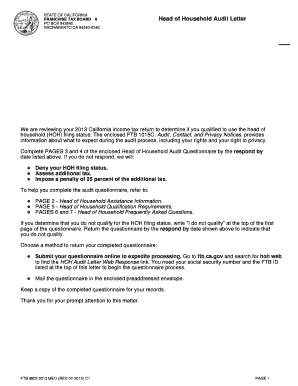

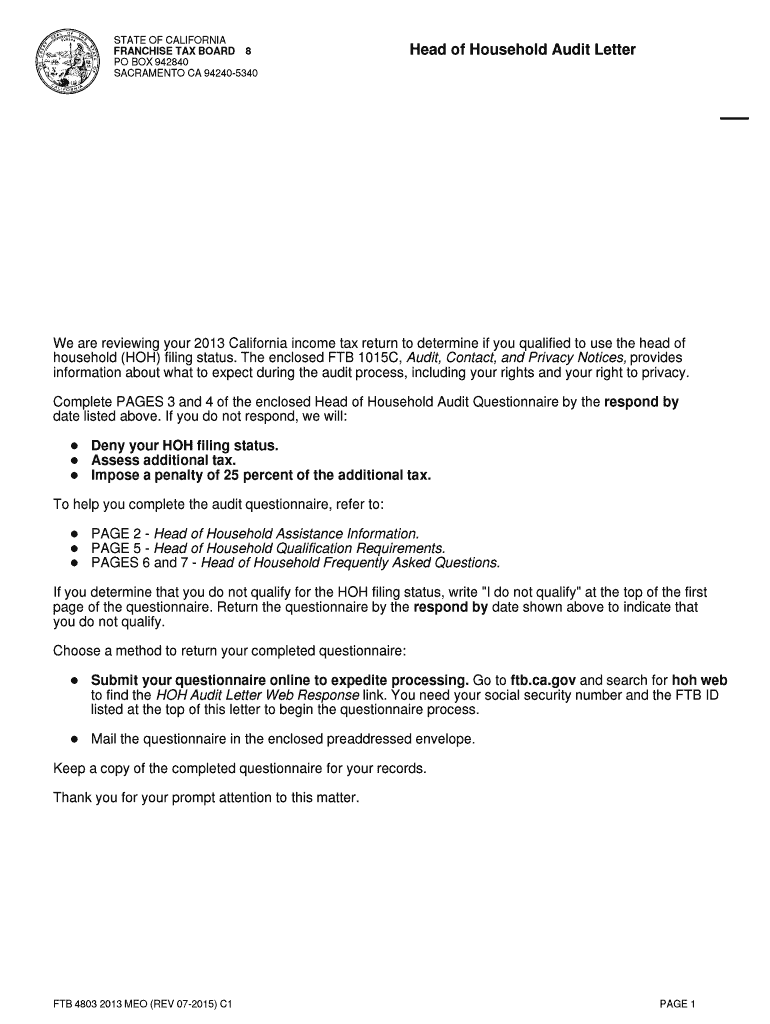

2015 2022 Form Ca Ftb 4803 Meo Fill Online Printable Fillable Blank Pdffiller

The opinions of the Court in two cases will be announced by Justice Ginsburg.

. McColgan 68 CalApp2d 48 53-56 156 P2d 81 Thus dividend income will not be allocated in relation to the operations of the corporation owning the shares but is attributed to the domicile. FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. Although Californias statute does not directly impose a tax on nonunitary income it measures the amount of additional unitary income that becomes subject to its taxation through reducing the deduction by precisely the amount of nonunitary income that the taxpayer has received.

I was supposed to get 4700 something. Unity of Apportioning Pass-through Entities. I have a traffic ticket which I extended the court date 3 months later.

Franchise Tax Bd supra 463 US. Franchise Tax Bd supra 60 Cal2d at p. 289 359 P2d 625.

Hyatt II supra at ___ slip op at 1. Audio Transcription for Oral Argument March 28 1994 in Barclays Bank PLC v. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so there is no way this money is from that year.

0 7 34363 Reply. The board has asked us to overrule Hall and hold that the Nevada courts lack jurisdiction to hear this lawsuit. Chase Brass Copper Co.

FRANCHISE TAX BOARD Legal Division MS A260 PO Box 1720 Rancho Cordova CA 95741-1720. McLaren and Butler California Tax Laws of 1929 pp. The net income is to be computed by taking from the gross income as defined by section 6 of the act all allowable deductions.

For example the FTB is entitled to forego an independent audit and rely on the IRSs determination of a. For general information see the Franchise Tax Overview. The Court is equally divided on this question and we consequently affirm the Nevada.

It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund. There are 7222 searches per month from people that come from terms like franchise tax bo or similar. I am a bot and this action was performed automatically.

I received a deposit from franchise tax board not matching what my tax return said do I receive my tax return in amounts. 456 493-494 Income from profit-making activities with nonmembers is excluded from deductibility and thus forms part of the tax base. Franchise Tax Bd.

Update a Franchise Tax Account Complete the Franchise Tax Accountability Questionnaire. FRANCHISE-TAX-BO-PAYMENTS has been in the DB for a while it is the number 23352. In Ceridian Corp.

It comes from Panama. The measure of the tax is limited to income reasonably attributable to sources in California. Franchise Tax Bd 268 CalApp2d 363 367 74 CalRptr.

Please contact the moderators of this subreddit if you have any questions or concerns. 425 We may constitutionally apply any test to determine unity as long as there is a flow of value between the segments which make up a unitary business. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

Franchise Tax Bd 463 U. CGC-10-495911 And five other cases Here we consider how California calculates income taxes on multistate businesses. FRANCHISE TAX BOARD San Francisco County Defendant and Respondent.

175 77 LEd2d at pp. The franchise tax is declared by the statute to be a tax according to or measured by the corporations net income. LEGAL RULING 2021-01 SUBJECT.

Fibreboard Paper Products Corp. File a return make a payment or check your refund. 4 1967 Compact which.

The Franchise Tax Board hereinafter called the Board contends that the transfer of the operating assets and patents from Pacific to Hall was in substance a distribution in complete liquidation of a subsidiary corporation resulting in cancellation of the subsidiarys stock. Log in to your MyFTB account. ISSUE Whether in a series of differing situations pass-through entity holding companies are unitary with.

I got it in my bank account but Im not sure if its my tax return. This also happened to me. For LLCs the franchise tax is 800.

___ ______ 2016 slip op at 49 Hyatt II. 1 Best answer Accepted Solutions AnthonyC. In this case a private citizen a resident of Nevada has brought a suit in Nevadas courts against the Franchise Tax Board of California an agency of the State of California.

Traynor National Bank Taxation in California 17 CalL. Audio Transcription for Opinion Announcement June 20 1994 in Barclays Bank PLC v. Of California William H.

The franchise tax is impressed annually on corporations for the privilege of exercising the corporate franchise within California. Copper is not fabricated by Kennecott but is sold through a subsidiary of Kennecott Kennecott Sales Wertin v. Code 23151 fn.

Although the question was briefed and argued the Court was equally divided on whether to overrule Hall and thus affirmed the jurisdiction of the Nevada Supreme Court. California Franchise Tax Board. 2d 407 423-424 11 Cal.

In California the franchise tax rate for S corporations is the greater of either 800 or 15 of the corporations net income. Change a Business Address or Contact Information. W-4 IRS Withholding Calculator.

In 1974 California joined the Multistate Tax Compact Multistate Tax Com Model Multistate Tax Compact Aug. Franchise Tax Board 55 Cal. 2000 85 CalApp4th 875 102 CalRptr2d 611 Ceridian the First District held that a corporate tax deduction for dividends paid to the corporation from the corporations insurance company subsidiaries violated the commerce clause because the deduction was limited to dividends paid from income from California.

How To Speak With An Actual Representative At The Franchise Tax Board Of California Ca Ftb Quora

Stop Wage Garnishments From The California Franchise Tax Board Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

State Of California Real Estate Withholding Viva Escrow

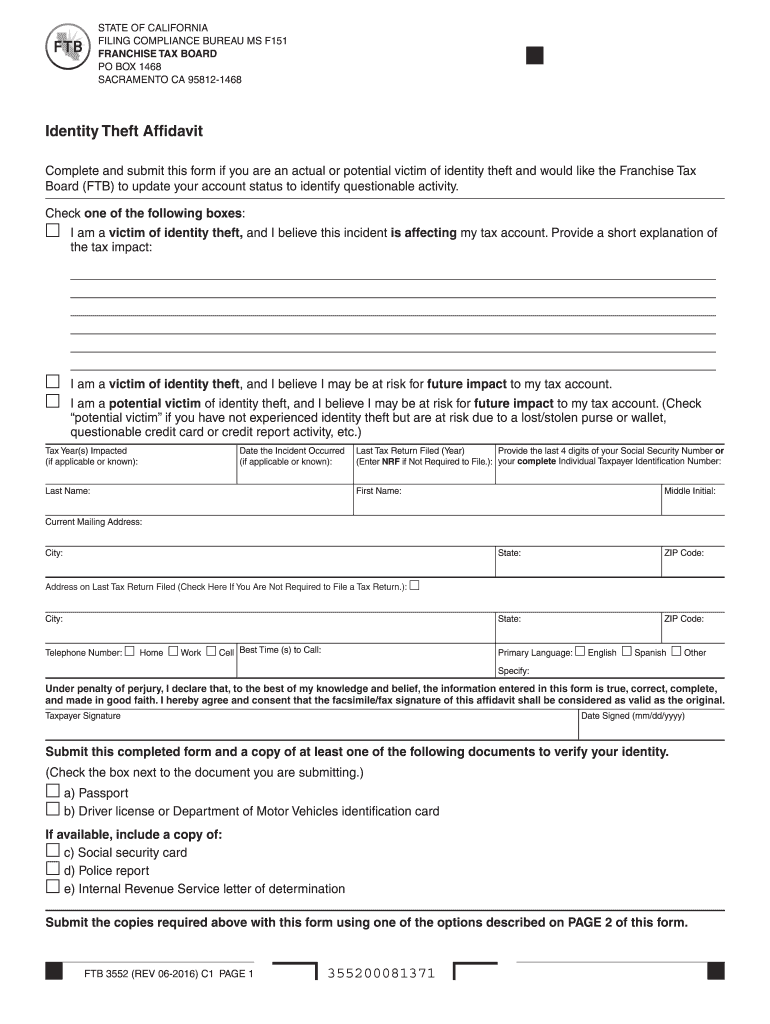

2016 2022 Form Ca Ftb 3552 Pc Fill Online Printable Fillable Blank Pdffiller

What Does Legal Order Debit Franchise Tax Board Mean Larson Tax Relief

The Limits Of Nudging Why Can T California Get People To Take Free Money Planet Money Npr

2015 2022 Form Ca Ftb 4803 Meo Fill Online Printable Fillable Blank Pdffiller

Stop Wage Garnishments From The California Franchise Tax Board Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

California Ftb Rjs Law Tax Attorney San Diego